How to Invest in DeFi with Ambire Wallet

Explore how Ambire Wallet simplifies DeFi investing with advanced security features, direct dApp access, innovative tools like transaction batching & simulation, and gas management.

Unlike traditional finance, DeFi offers an alternative where transactions are faster, cheaper, more secure, and open to everyone, regardless of geographical location or economic status. This sector is built on transparency, accessibility, and autonomy and is powered by blockchain technology.

As DeFi continues to grow, with billions of dollars locked in its protocols, the opportunity for investors is immense. From earning interest on stablecoins to participating in the governance of decentralized protocols, DeFi is reshaping the landscape of investment opportunities. However, navigating this new world can be daunting for some users. This is where Ambire Wallet excels. Designed with both crypto degen needs and the DeFi novice in mind, Ambire Wallet is your gateway to the vast opportunities within decentralized finance.

Let's embark on this journey together, exploring how to leverage the power of DeFi to grow your portfolio and why Ambire Wallet is your ideal companion in this adventure.

Preparing to invest in DeFi

Venturing into the world of Decentralized Finance (DeFi) can be both exhilarating and overwhelming, especially for those new to the space. Before diving headfirst into DeFi investments, there are several key considerations and preparatory steps to ensure a smooth and successful journey.

Setting up a Web3 wallet

First, you would need a Web3 wallet. We recommend using a smart contract wallet, such as Ambire Wallet. It allows you to store and manage cryptocurrencies and tokens securely and interact directly with DeFi protocols. Ambire Wallet offers an intuitive interface and robust security features, making it an ideal choice for investing in DeFi.

Here's how to get started:

- Create an Ambire Wallet account: Visit the Ambire Wallet website and follow the instructions to create a Web3 wallet. Alternatively, you can download the mobile app from Google Play or the App Store.

- Secure your wallet: Set a strong account password and back up your wallet by saving the JSON file in a secure place. Usually, when you create a crypto wallet, you must write down a so-called seed phrase, a 12/24 word sequence that grants you access to your funds. Thanks to Account Abstraction, in Ambire Wallet, you skip this step while keeping full custody of your funds (learn more about how we do this). After you create your account, we strongly recommend you add 2FA and a hardware wallet as a signer key to secure your funds better. These security mechanisms make your account as secure as cold storage without keeping your digital assets dormant.

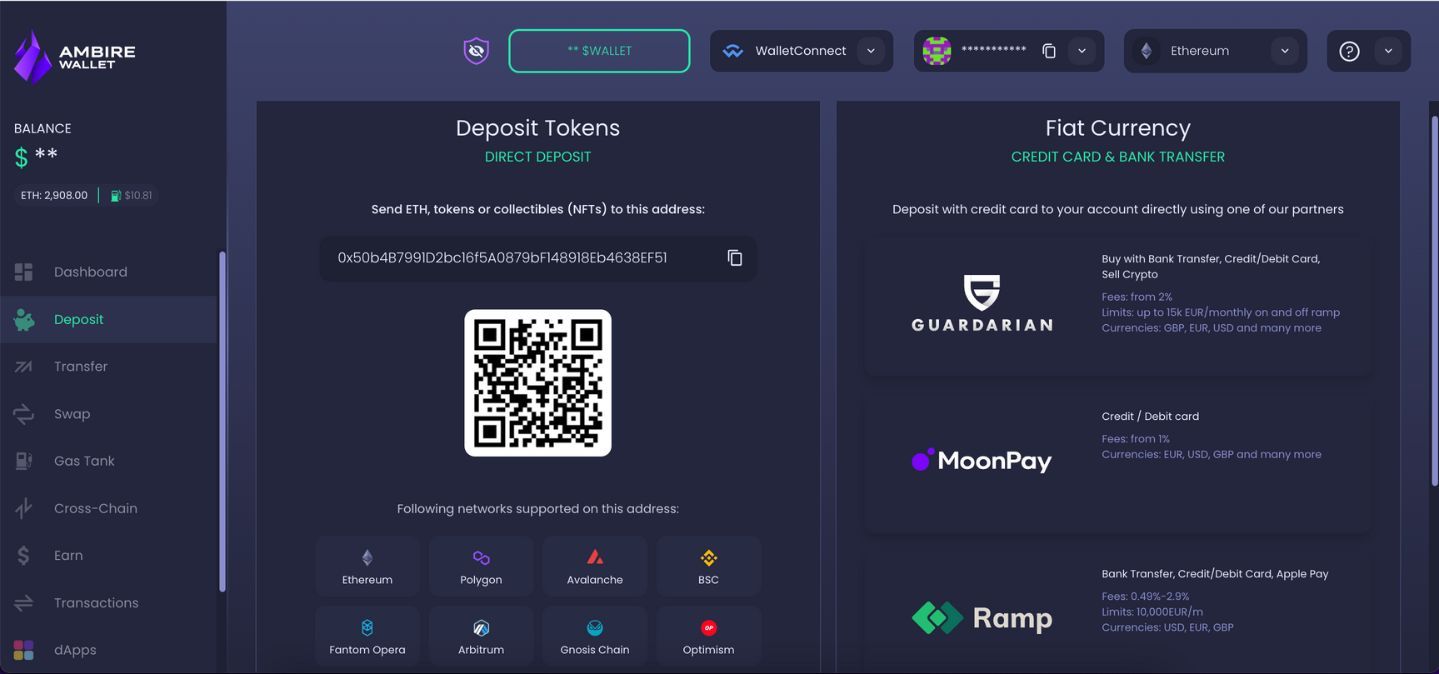

- Fund your account: Transfer cryptocurrency into your Ambire Wallet from an exchange or use the built-in on-ramps to buy stablecoins like USDC and USDT or native tokens like Ether, MATIC, and ARB. These funds will serve as your capital for DeFi investments.

Assessing risks and doing due diligence

Investing in DeFi comes with its set of risks. The volatile nature of cryptocurrencies, the possibility of smart contract vulnerabilities, and the regulatory landscape are factors that require careful consideration. It's essential to do the following:

- Research thoroughly: Before investing in any DeFi project, conduct thorough research. Look into the project's team, technology, community support, and security audits. You can check if the protocol has been hacked in the past and for what amount.

- Start small: If you're new to DeFi, consider starting with a small investment to familiarize yourself with the process without exposing yourself to significant risk.

- Stay informed: The DeFi space is fast-evolving, with new projects and updates emerging regularly. Knowing the latest trends and developments can help you make better investment decisions.

Maximizing your DeFi investments

To maximize your DeFi investment returns:

- Diversify your strategies: Don't put all your eggs in one basket. Explore different DeFi strategies and find the right mix for your investment goals.

- Stay informed: Keep up with the latest DeFi trends and updates. Ambire Wallet's community and resources can be invaluable in staying ahead.

- Manage risks: Use the risk management tools available in DeFi protocols, including setting limits and tracking your investments in real time.

DeFi investing strategies

As we delve into DeFi investing strategies, it's crucial to approach this innovative financial landscape with a strategy that aligns with your goals, risk tolerance, and investment philosophy. The DeFi ecosystem offers many opportunities to grow your portfolio, each with unique characteristics, advantages, and considerations. Let's explore some of the most popular DeFi investing strategies, shall we?

HODL

The Hodl strategy is popular among investors who prefer to buy and hold cryptocurrencies long-term, betting on their value increasing over time. Ambire Wallet's robust security features, including 2FA and hardware wallet support, make it an ideal choice for hodlers. The wallet ensures that your digital assets remain safe while you hold them, waiting for the right moment to realize their potential growth. Remember that keeping your assets too long can lead to missed opportunities in a highly volatile market, and the primary risk lies in market fluctuations that could decrease the value of cryptocurrencies over time.

Borrowing and lending funds

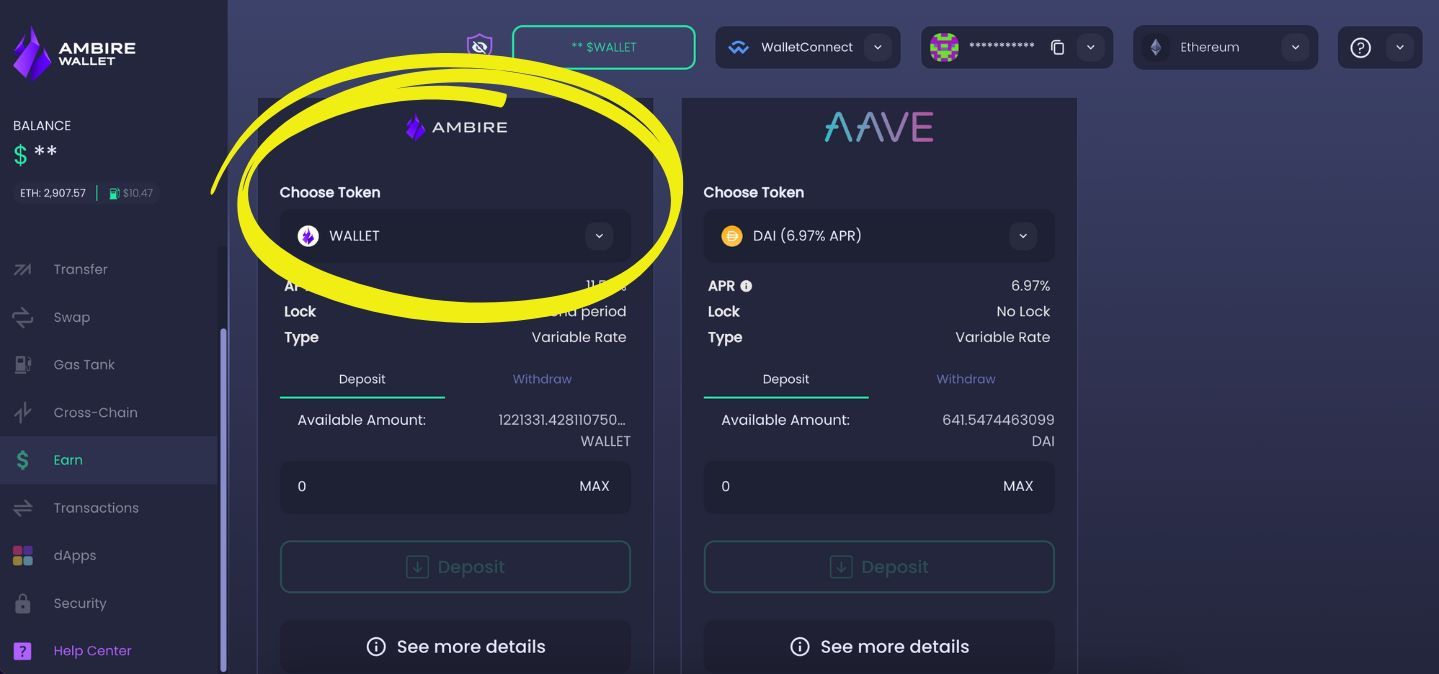

Borrowing and lending funds through DeFi platforms like Aave and Compound allows you to earn interest on deposits and borrow against your crypto assets. This strategy enables passive income and liquidity flexibility but comes with the risk of fluctuating interest rates and the potential for liquidation if collateral values fall. Smart contract vulnerabilities and market volatility present significant risks, though Ambire Wallet’s secure integration of these platforms can mitigate exposure to malicious attacks.

Yield farming

Yield farming involves lending or staking cryptocurrency in exchange for interest or fees in return. Platforms accessible via Ambire Wallet, such as SushiSwap and Balancer, offer opportunities for yield farming. While potentially offering high returns, this strategy requires active management and carries the risks of loss and volatile APYs alongside smart contract vulnerabilities.

Liquidity mining

Like yield farming, liquidity mining rewards users for providing liquidity to DeFi protocols, often with native tokens. Engaging in liquidity mining on platforms like Lido can enhance potential rewards but is subject to impermanent loss and smart contract failure. Direct access to these platforms through Ambire Wallet's dApp Catalog helps reduce operational and security risks associated with phishing attacks.

Traditional staking

Traditional staking supports the operation of blockchain networks by locking up cryptocurrencies and offering rewards in return. This strategy, facilitated for tokens like $WALLET and $ADX via Ambire Wallet, for example, contributes to network security with less complexity than yield farming. However, it requires locking up assets, reducing liquidity, and carries the risk of validator performance affecting rewards.

Investing in the DeFi Indexеs

The DeFi Pulse Index (DPI) represents a basket of leading DeFi tokens for those interested in a diversified investment approach. Investing in the DeFi Pulse Index (DPI) through platforms like Balancer diversifies risk across several top DeFi projects. This strategy simplifies exposure to the DeFi sector without investing in individual tokens but ties performance to the underlying assets, which can vary. Market volatility is the primary risk, though the diversified nature of indices can mitigate individual asset volatility.

How Ambire Wallet supercharges DeFi investing

Ambire Wallet is a powerful tool designed to maximize investments while ensuring top-notch security and efficiency. Here's how specific features of Ambire Wallet contribute to a superior DeFi experience:

Limited token approvals

Ambire Wallet integrates an essential security feature known as limited token approvals. This mechanism allows users to set maximum limits on the amount a smart contract can move or spend, providing an additional layer of security against unauthorized transactions.

In the event of a compromised contract or wallet, limited approvals significantly reduce the potential loss, as only the pre-approved amount can be accessed. This feature exemplifies Ambire Wallet's commitment to safeguarding users' assets through proactive security measures.

Transaction batching for efficiency and cost savings

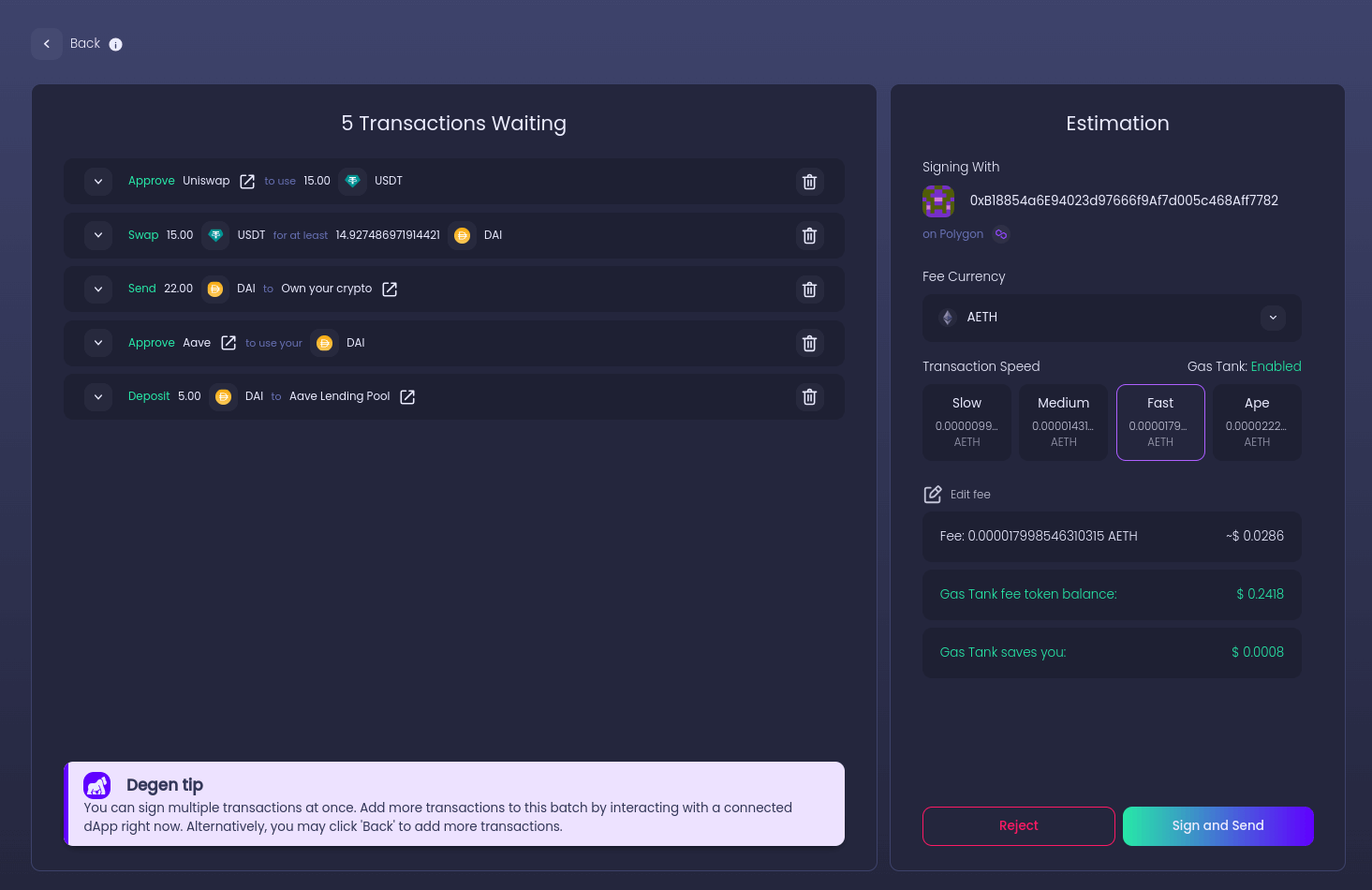

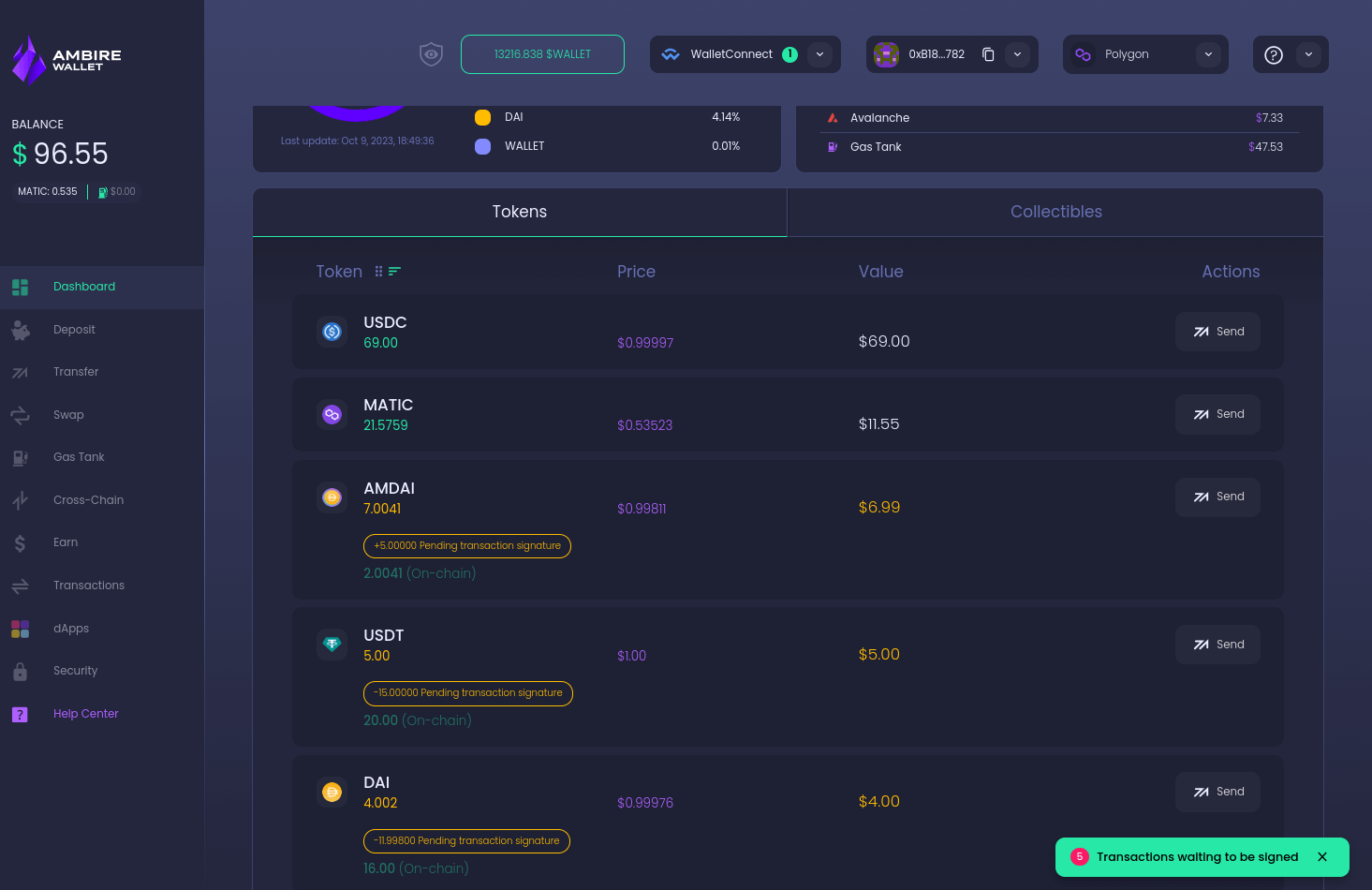

Ambire Wallet's transaction batching feature allows you to execute multiple transactions simultaneously, significantly reducing the gas fees associated with individual transactions. This efficiency saves time and minimizes financial overhead, making DeFi investing more accessible and sustainable.

Transaction simulation for informed decisions

Before finalizing any transaction, Ambire Wallet offers a simulation feature that previews the transaction outcome and the expected balance. This crucial feature helps prevent failed transactions and financial losses by allowing users to make informed decisions and adjust their actions in real time.

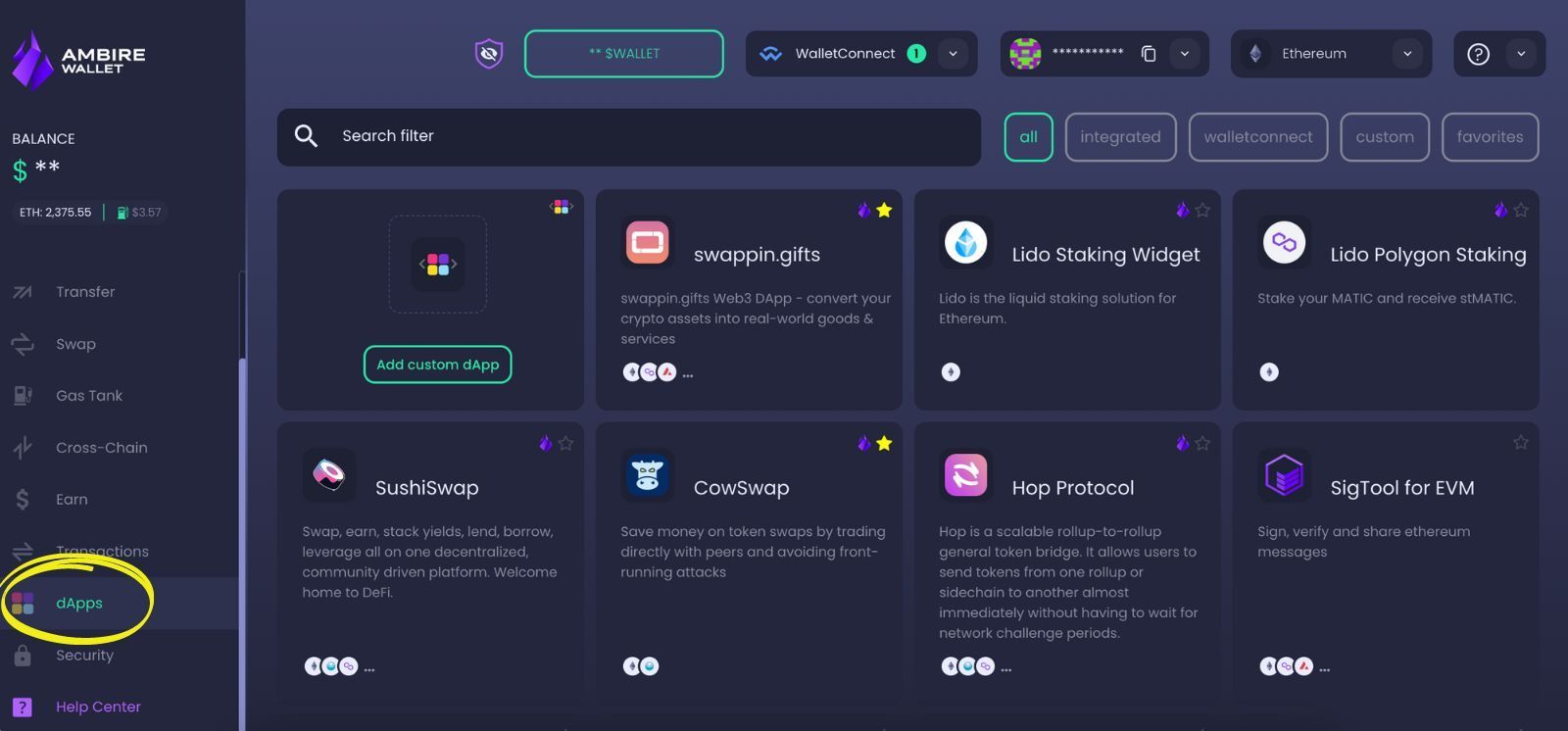

Built-in dApp Catalog with direct access to DeFi protocols

Ambire Wallet has a built-in dApp catalog, offering seamless integration with a wide range of DeFi protocols. This direct access facilitates easy exploration and interaction with DeFi projects, from swapping tokens on Uniswap to lending on Aave, all within a single, secure environment.

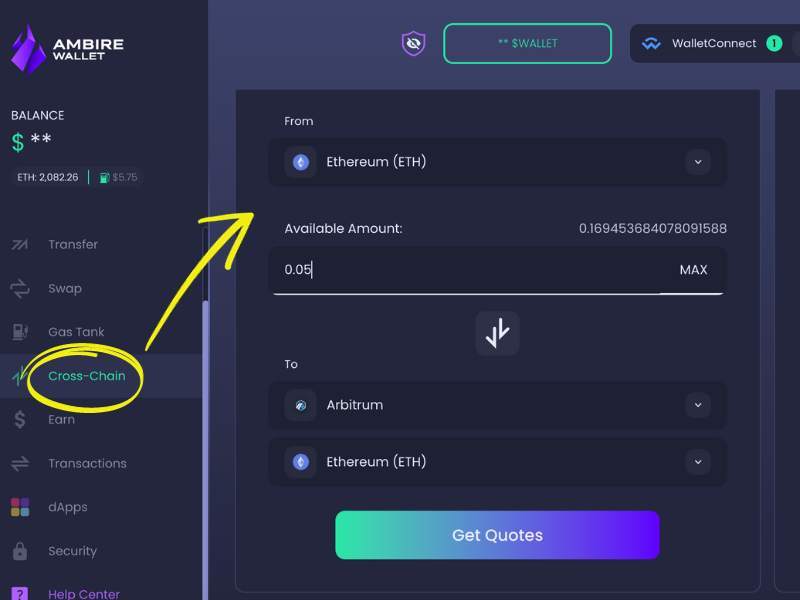

Integrated swapping and bridging functionality

The wallet's built-in swapping and bridging functionalities enable you to exchange tokens and move assets across networks effortlessly. This feature saves time and enhances the user's ability to respond to market conditions quickly, preventing potential financial losses by avoiding the need for multiple platforms.

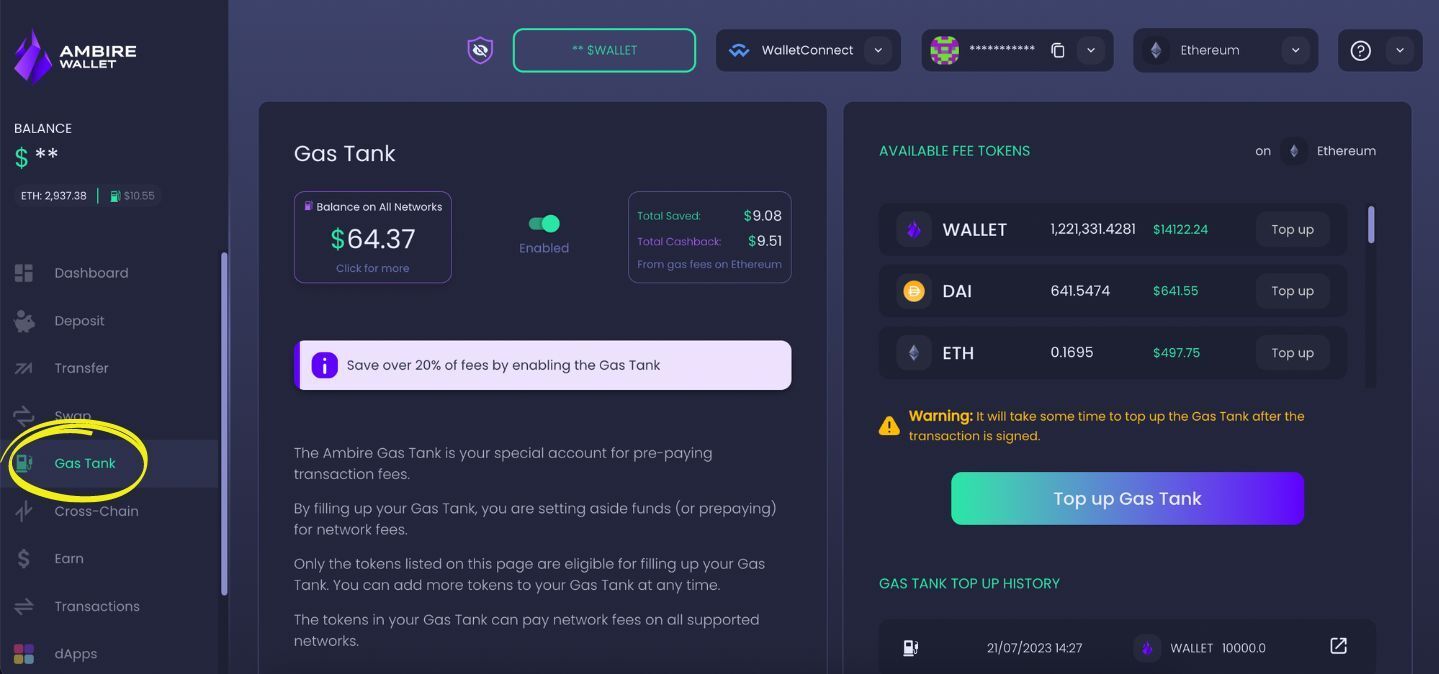

Unique Gas Tank feature for gas abstraction

One of Ambire Wallet's standout features is the Gas Tank, which allows users to prepay gas fees on one network (in stablecoins and other tokens) and utilize them across all available networks. This innovative approach streamlines the investment process and ensures you can execute transactions promptly without worrying about having networks’ native tokens and fluctuating gas prices. Additionally, you get cash back for the gas you spend.

Conclusion

Decentralized Finance (DeFi) presents an exciting frontier for investors, offering opportunities beyond traditional financial systems. This comprehensive guide explored how to invest in DeFi with Ambire Wallet, highlighting its user-friendly interface, robust security features, and seamless integration with many DeFi protocols. From transaction batching and real-time monitoring to the unique Gas Tank feature and limited approvals for enhanced security, Ambire Wallet stands out as a superior platform for entering and thriving in the DeFi space.

As we conclude, remember that the journey into DeFi involves constant learning and adaptation. With tools like Ambire Wallet, you're not just investing in DeFi but embracing a future where finance is open, accessible, and controlled.

Start your DeFi investment journey with Ambire Wallet today and unlock the potential of decentralized finance. Embrace the future of investing, where the power to grow your portfolio is at your fingertips, supported by the unparalleled capabilities of Ambire Wallet.

Interested in Ambire? Follow us:

Discord | X (Twitter) | Reddit | GitHub | Telegram | Facebook