How to Reduce Gas Fees

Gas fees are essential for blockchain operations but can be costly. The article delves into the mechanics of gas fees, their calculation, and factors affecting their fluctuation. It also provides practical tips and strategies for reducing gas fees, such as using Layer 2 networks and gas tokens.

A Guide for the Best Fee-Saving Strategies

Gas fees pay for the execution of operations on a blockchain. They represent compensation for the computational power required for operations/transactions to be executed.

Gas fees are subject to change according to variables such as network congestion, available validators, operation complexity, etc., so it is paramount to understand how they work and what methods you can use to save on your expenses.

This article explains how gas fees are determined, why gas fees can get so high, and how to reduce gas fees when transacting in the Ethereum Virtual Machine (EVM) ecosystem.

Understanding Gas Fees

Gas fees are required on blockchains to fuel the operations and interactions between users and applications. Different gas fee calculation algorithms can be set in place for each network under the specific blockchain architecture and vision.

Regardless of blockchain, gas fees allow users to make transactions while rewarding the entities that verify, process, and broadcast/deploy transactions on-chain for their computational effort. Depending on the network's consensus mechanism, this computational effort can be realized to a miner as an electricity cost (Proof of Work) or to a validator as a financial stake (Proof of Stake).

Gas fees are traditionally paid in the native token of the blockchain.

How Gas Fees Work on EVM

In the case of the Ethereum network, the native token is Ether (ETH), and the gas prices are calculated in gwei, a subdivision of ETH (1 gwei = 0.000000001 ETH / 10-9 ETH). The word 'gwei' represents 'giga-wei,' which is equal to 1 billion wei. Wei itself (named after Wei Dai, the creator of b-money) is the smallest unit denoted for ETH.

Gas fees have two components: the gas price and the gas limit. The current gas fee calculation formula on Ethereum has been maintained since the 2021 implementation of EIP 1559, aka the ‘London’ upgrade:

total fee = gas limit * (base fee + priority fee)

‘Gas limit’ represents the units of gas used for the operation; this is a standard of 21,000 for a regular transaction, but users can choose to amend it if they know/estimate the price for the current block being written.

‘Base fee’ is a value that shows the cost per unit of gas and is set by the protocol, proportional to the current block size vs. target block size.

‘Priority fee’ is the incentive that the user gives the validator to ensure their lead in the execution order of operations— simply put, users can pay a bigger tip to get in front of the line.

For example, if you wish to send 1 ETH to your business partner, the gas limit is 21,000 units, the base fee is 10 gwei, and you decide to include a tip of 4 gwei; therefore, your total gas fee will be:

21,000*(10+4) = 249,000 gwei or 0.000249 ETH

Why Gas Fees Can Be High

Gas fees can get high or vary significantly according to several factors, the most important ones being:

- The demand for transactions from the user side: how many people wish to execute operations at the same time

- Computational complexity required for execution: if there are operations that require a lot of computing power from the validators, they will slow down the networks’ pace and increase the need for tip incentives

- The available supply of validators/miners for the required effort: if there aren’t enough to meet demand, the users with higher fees (due to higher tips or gas limit configuration) will get their transactions executed, while the ones with lower fees will get rejected

- Status of the network itself: how busy/congested the blockchain is according to the number of participants

- Overall market evolution: just like other financial markets, the crypto market can be influenced by outside factors, which in turn can impact prices and gas fees

How to Check Gas Fees

Since crypto initially started rising through trading assets, several tools have been developed to help those who want to check and track gas prices, generally labeled gas monitoring tools. Here are a few of the most popular ones:

- Etherscan’s Gas Tracker — a dashboard that is updated every 15 seconds, where you can see at a glance the low, average, and high speeds of transactions, as well as estimated costs on the most popular DeFi platforms

- Blocknative ETH Gas Estimator — this is a Chrome extension that provides gas tracker charts with recent gas prices by block, even broken down between base fee and priority fee, as well as a 7-day gas price heatmap

- Cryptoneur Gas Fees Calculator — this tool lets you estimate gas fees on different EVM chains in your local currency and for different transaction speeds

- ETH Gas Now — an aggregator that displays Ethereum and NFT gas fees every 5 seconds, drawing data from various reputable sources

Some crypto wallets offer users gas fee estimates directly in their UI, bypassing the need to navigate to an external tool:

Remember that these tools are not bulletproof and should only be used as a reference when you think of what price to broadcast your transaction with to ensure its efficiency. Try to check more platforms and make an average of their data, but also keep in mind what kind of operations you are performing: simple ones might get through easier, while complex smart contract actions will require more effort and take more time; therefore, they will incur additional costs.

6 Strategies to Reduce Gas Fees

Batching Transactions

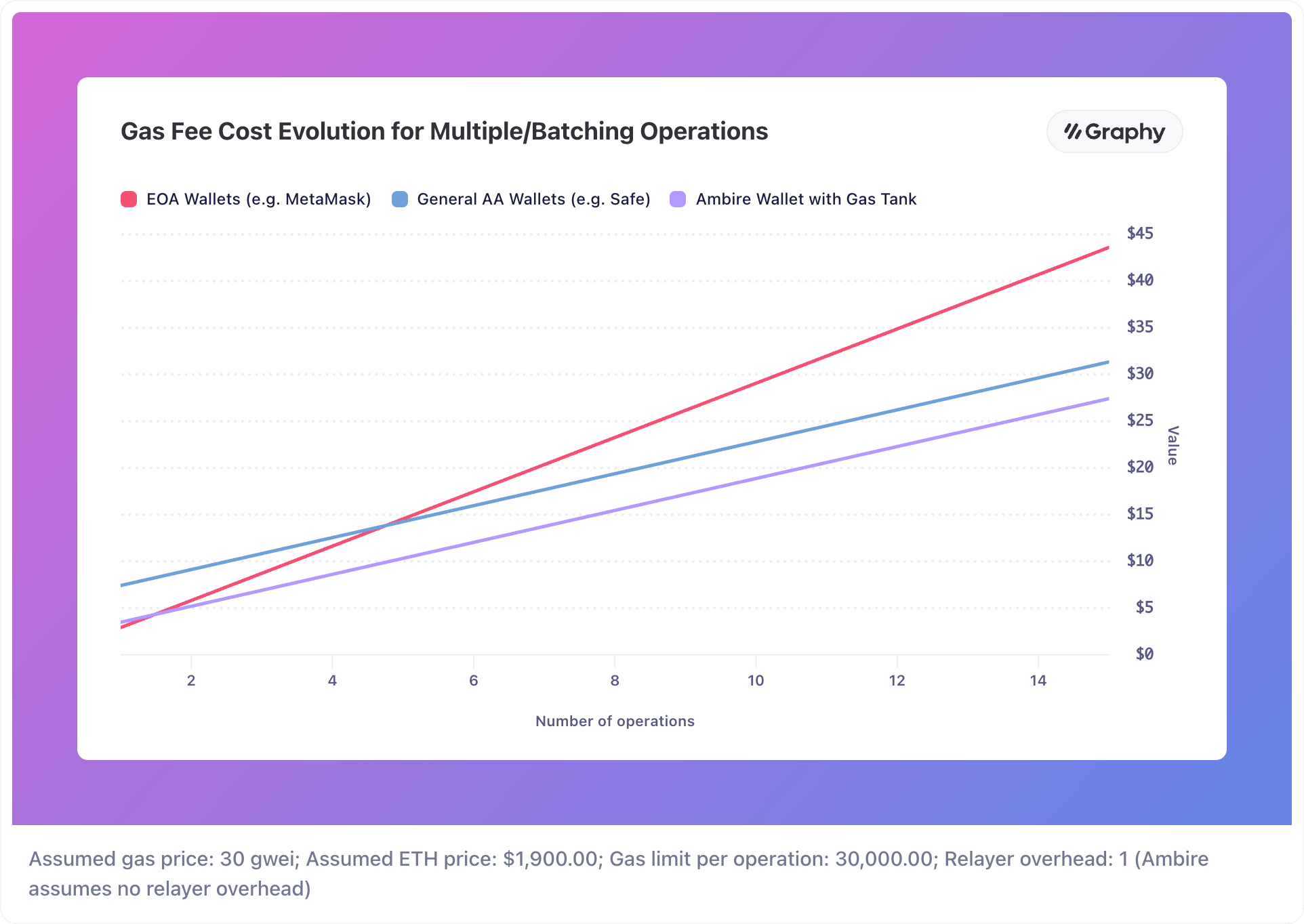

Batching transactions is an everyday use case for Account abstraction wallets, which allow you to bundle together multiple operations and only send and pay for the respective batch as one action. This means that instead of gathering fees for each transaction, you significantly reduce gas fees by paying for the entire cluster.

The more operations you batch, the higher your gas savings will be. Below is a look at how batching operations can gradually fade out the computational effort of smart contract wallets (through Account abstraction):

For a complete breakdown of our calculation approach, please refer to this document.

Choosing the Right Time

Just like a highway gets clogged at peak traffic times, so does the network get congested due to high usage. Throughout time, there have been different intervals when there are surges in use, as well as low points. The congestion level significantly impacts prices, so knowing when to submit your transactions can help you save on gas fees.

You can track the network congestion level through different blockchain scanners, but a good rule of thumb is to see where the biggest transaction volumes come from (usually the US and Asia). Try to avoid business hours for these regions, and remember that traders typically don’t work on weekends, so that might also be an excellent time to launch your transactions.

You can also use this dashboard as a reference for gas price evolution and see what time of day ETH gas is cheapest; therefore, it is ideal to transact.

Setting a Custom Gas Price

As explained earlier in the fee calculation section, you can manually adjust your gas price (most wallets provide this option through their interface).

You can set two components: the base fee (no. of units of gas), which is relative to the operation complexity, and the priority fee (tip), which is relative to the speed of the transaction.

A higher tip incentivizes validators to choose your transaction over others without tips.

Changing the gas limit to higher than 21,000 will increase your chances of execution if you’re doing complex operations (e.g., a large batch), while decreasing the number will help you save on fees and still get through if what you want to execute is something simple, like a transfer. Still, diminishing the gas limit carries the risk of not processing the transaction, so you should be very careful when modifying this parameter yourself.

Using Layer 2 Networks

Layer 2 (L2) chains have been a popular solution to streamline operations on Ethereum in recent years. Networks like Optimism, StarkEx, zkSync, etc., bring high processing speeds and significantly lower gas fees, with values as low as 0.015 USD per transaction. This is slowly (but surely) making them the networks of choice for EVM users, with Polygon and Arbitrum taking the lead.

Due to their scalability by design, whatever functions on the Ethereum should also work on Layer 2s, so if you’re used to interacting with a dApp on the main net, you’ll probably be able to do so from your preferred L2.

Proclaimed as the future of Ethereum, these chains are already amassing complex ecosystems of applications. However, it would be best to remember that liquidity can greatly vary on Layer 2 networks.

Combined with Account abstraction, Layer 2 chains can truly ease and save on your EVM journey: innovations such as the Ambire Gas Tank allow you to prepay for gas fees in L2 tokens to fund your operations elsewhere cheaply — you load it with MATIC/ARB/OP, etc. and when enabled, it can pay fees on any supported network, including Ethereum.

Using Gas Tokens

The painful problem of gas prices has long been a burden for crypto users, so solutions have been developed to bypass this issue. Gas tokens are one such approach that works on Ethereum because of its storage refund mechanics — a system that refunds users who delete their storage variables.

The two methods for obtaining storage refunds are clearing storage from a smart contract and destroying a contract. The latter, which refunds 24000 gas, is considered more efficient.

Gas tokens work as follows: when gas prices are low, you create or mint tokens and save data into the token contract’s storage. When prices increase, you spend or free your tokens by sending them back to their contract for destruction, in this way freeing up the data that was previously saved.

To use gas tokens, navigate to their contract page on Etherscan after connecting your wallet and call the Mint and Free functions, as needed. When freeing your tokens, you’ll receive a refund in ETH.

One of the most popular such projects is GasToken.io.

Paying Gas in Stablecoins or Other Tokens

Stablecoins like DAI, USDT, or USDC are among the most loved crypto solutions, highly appreciated for their versatility. Not only can they be used cross-chain for equivalating funds, but they can also be used for paying gas fees instead of native tokens, significantly simplifying the user experience.

Account Abstraction wallets that leverage smart contracts have taken the idea of flexibility for gas fee tokens to new heights. They propose solutions that abstract the need for a particular token and allow users to pay gas fees in whatever token they hold.

For example, with Ambire’s Gas Tank, you can prepay for fees by sending your tokens of choice in advance to the relayer, just like you would with a prepaid sim card to a network operator. Then, you can spend your gas on whatever network you need and is supported.

Moreover, Ambire’s native WALLET and xWALLET tokens can also be used to pay for gas, further streamlining your operational flow.

Conclusion

Gas fees are an inherent and indispensable component of crypto, and it will take some time until they are no longer an impediment to large adoption and become insignificant for users.

Luckily, we already have strong proof that Ethereum can fix gas fee issues: from gas tracking tools to Layer 2 solutions, gas tokens, or Account abstraction wallets, there are already many options available so that you can take control of your spending and make sure your ETH gas fees aren’t so high.

Interested in Ambire? Follow us:

Discord | X (Twitter) | Reddit | GitHub | Telegram | Facebook