What Are Crypto Perpetual Swaps and How to Trade Them on GMX

Crypto perpetual swaps offer a dynamic way to trade, blending the flexibility of spot trading with the power of leverage. Our guide explains how.

After delving into token swaps last week, we will demystify perpetual swaps and show you how to trade them on GMX. The platform has been a pioneer since its inception in September 2021, revolutionizing DeFi trading with decentralized perpetual swap contracts and up to 50X leverage.

Operating on Arbitrum One and Avalanche, GMX stands out for its low fees and deep liquidity, enhancing your trading experience. Join us as we explore GMX's world of transparent, blockchain-powered trading.

What are perpetual swaps?

Perpetual swaps, or perpetual swap contracts, are financial instruments used for speculating on assets’ prices. These contracts allow traders to speculate on the price of a cryptocurrency without an expiry date, differentiating them from traditional futures contracts. Since perpetual contracts lack expiration dates, profits, and losses can continue accumulating until traders decide to close their positions or face liquidation in cases of significant, unrecoverable losses.

GMX, a notable player in decentralized finance, offers a seamless platform for trading these perpetual swap contracts. It provides a user-friendly interface and a robust system, making it an ideal choice for navigating the complexities and volatility of crypto markets in perpetual swap trading.

How do perpetual swaps work?

The operation of perpetual swaps hinges on a funding rate mechanism, ensuring the contract price mirrors the underlying asset's market price. This mechanism involves periodic payments between traders based on the difference between the contract's price and the average spot price (Index price). If the contract's price is higher, long-position holders pay short-position holders, and vice versa. This system of payments helps align the perpetual swap price with current market conditions, making it suitable for both speculation and hedging.

What you need to know before you start trading

Understanding leverage and margin

Leverage in trading is similar to using a lever to amplify force. In financial terms, it's using borrowed capital to increase the potential return on an investment. For example, with leverage of 20x, a $500 investment controls a $10,000 position. However, this increases the risk significantly. You could lose your entire investment if the market moves against your position by just 5%.

Margin is the amount of capital required to open a leveraged position, serving as collateral against the borrowed funds. When a position is liquidated in trading with leverage, the margin used to open that position is typically lost. For example, if you use $500 as a margin to open a 20x leveraged position (controlling $10,000), and the market moves against your position by 5%, the value of your position drops to $9,500. Since this is below the required margin to maintain the position, it gets liquidated, and your $500 margin is lost to cover the shortfall.

Due to the high volatility of the crypto market, these concepts take on significant importance in the context of perpetual swaps. Leveraging in perpetual swaps can lead to substantial gains but also poses a risk of equally substantial losses. Therefore, it's crucial to understand and judiciously use leverage and margin to manage the heightened risks inherent in trading perpetual swaps.

Risk management

Effective risk management is essential in the highly volatile world of perpetual swaps. This involves limiting the amount of capital risked per trade, diversifying across different assets, and not over-leveraging your positions. It's essential to be aware of market conditions and adjust your strategies accordingly. Implementing tools like stop-loss orders can help mitigate losses, but the key lies in a disciplined approach to trading, recognizing when to take profits and when to cut losses.

Developing a trading plan and discipline

Creating a trading plan for perpetual swaps involves setting clear objectives and strategies. This plan should outline your financial goals, the level of risk you are willing to take, and the strategy for entering and exiting trades. Discipline is essential, and it requires adhering strictly to your plan and avoiding impulsive decisions influenced by market hype or emotions. Consistently following your trading plan helps you make rational decisions, improving the chances of successful trading outcomes.

Know the fees

GMX charges a fee of 0.05% or 0.07% for opening and closing positions based on the trade's effect on the pool's balance. The collateral for long positions varies with the asset; for short positions, it's USDC. Swap fees range from 0.05% to 0.07% for tokens and 0.005% to 0.02% for USDC. Additionally, GMX ensures smooth transactions by setting aside native tokens (ETH on Arbitrum and AVAX on Avalanche) to cover gas costs, which are reimbursed post-transaction.

In GMX leveraged trading, the "Borrow Fee" is determined by the balance of long and short positions. If long positions outweigh shorts, then traders holding longs pay the fee. Conversely, short position holders incur the borrowing fee if shorts are more prevalent. This hourly charge is related to the ratio of the borrowed amount to the total pool assets, adjusting based on the current demand and balance of trading positions.

To manage and minimize fees, consider the frequency and timing of trades and the necessity of swaps. Efficient planning can help align trading actions with lower fee periods, optimizing overall trading costs.

How to trade perpetual swaps on GMX using Ambire Wallet

The following step-by-step will guide you through opening and closing a position on GMX with Ambire Walle on the Arbitrum network. Ensure you have an active and funded crypto account. When using GMX on Arbitrum, you must have some disposable Ethereum for gas. Conversely, you need some AVAX tokens when trading on the Avalanche network. To save on gas fees, top-up your Gas Tank and enable it. It allows you to pay for gas cross-chain, using funds deposited on one network to pay for gas on another. You can use stablecoins and other ERC-20 tokens for transfer fees.

As a disclaimer, perpetual swaps involve higher risks than regular swaps. Proceed with caution and limit your exposure to mitigate any substantial losses.

Opening a position on GMX

Step 1. Access GMX in Ambire Wallet

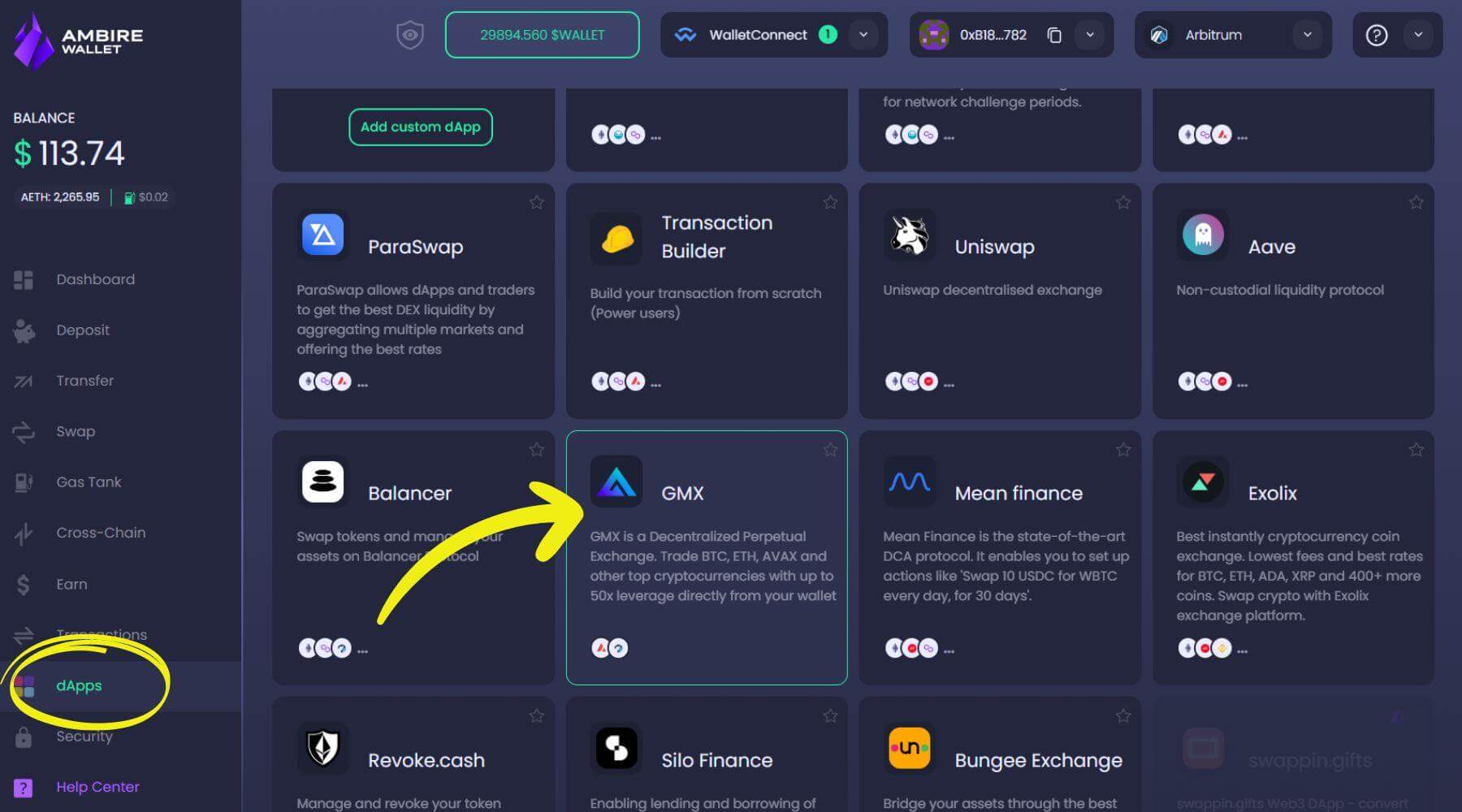

- Go to Ambire's web wallet.

- Navigate to the "dApps" tab and select GMX. Your Ambire account will be automatically connected to GMX. This integration ensures that you are interacting with the legitimate GMX platform.

Step 2. Choose a trading pair and open a position

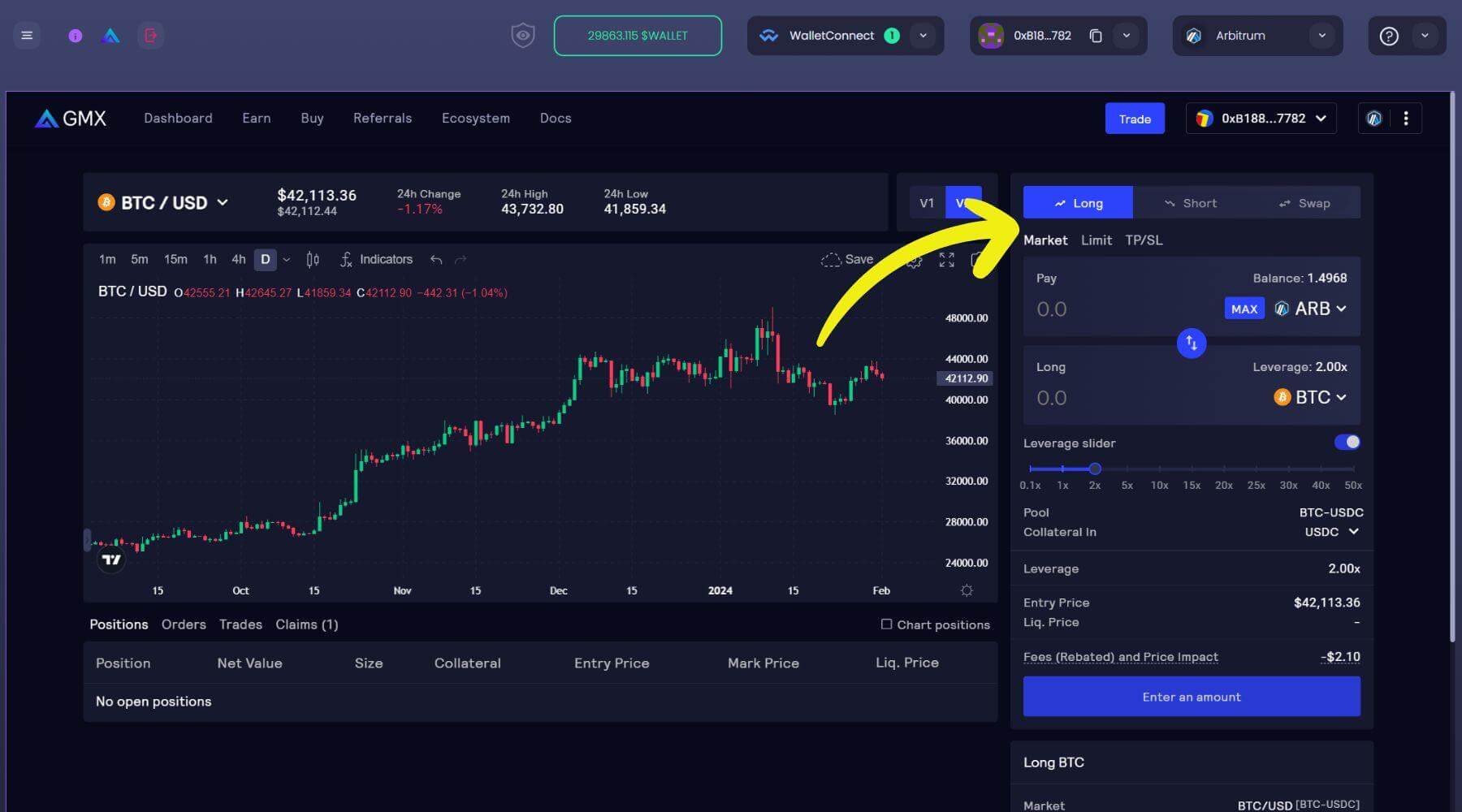

- On the left-hand side, you'll find a chart and a list of available token pairs on GMX. Choose the pair you want to trade—for example, Bitcoin (BTC)/USD.

- On the right-hand side, you'll see the trading module. Decide whether you want to go long (expecting the asset's price to rise) or short (expecting the asset's price to fall).

- Select "Market," "Limit," or TP/SL (Take Profit/Stop Loss) order based on your preference.

- Choose the collateral token, for example, the ARB token, and specify the token amount.

- Adjust the slider to your desired exposure if you want to use leverage.

- Confirm your position by selecting the ‘Long’ or ‘Short’ buttons.

Step 3. Review the position details and confirm it

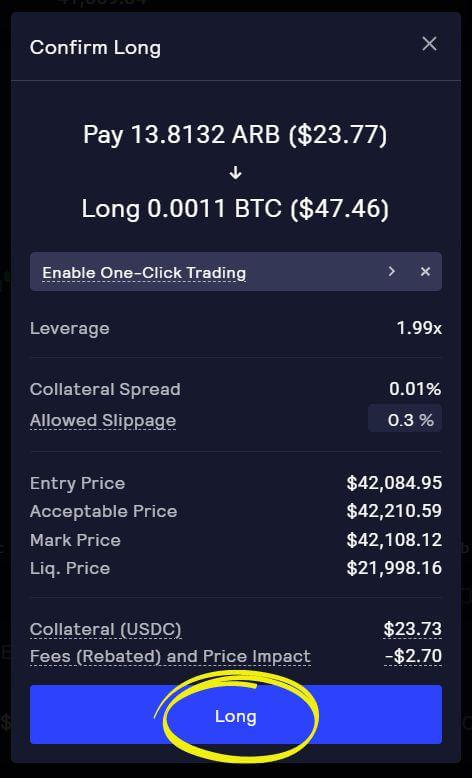

- In the confirmation modal, check the transaction details before confirming ‘Long’ or ‘Short’ by clicking the respective button.

Step 4. Sign and send the transaction

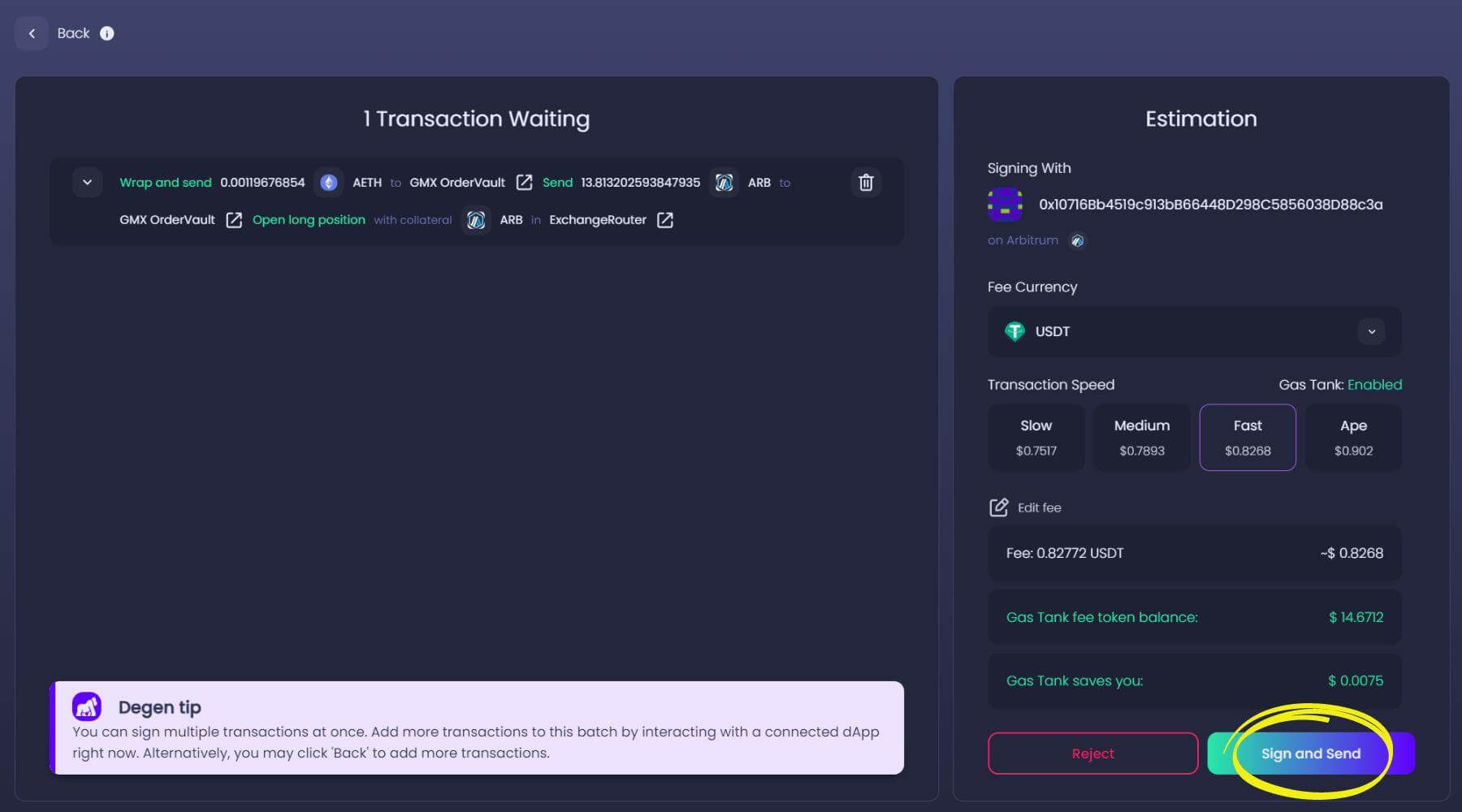

- Review the transaction details.

- Pick the fee currency and transaction speed, then select ‘Sign and Send.’

Closing a position on GMX

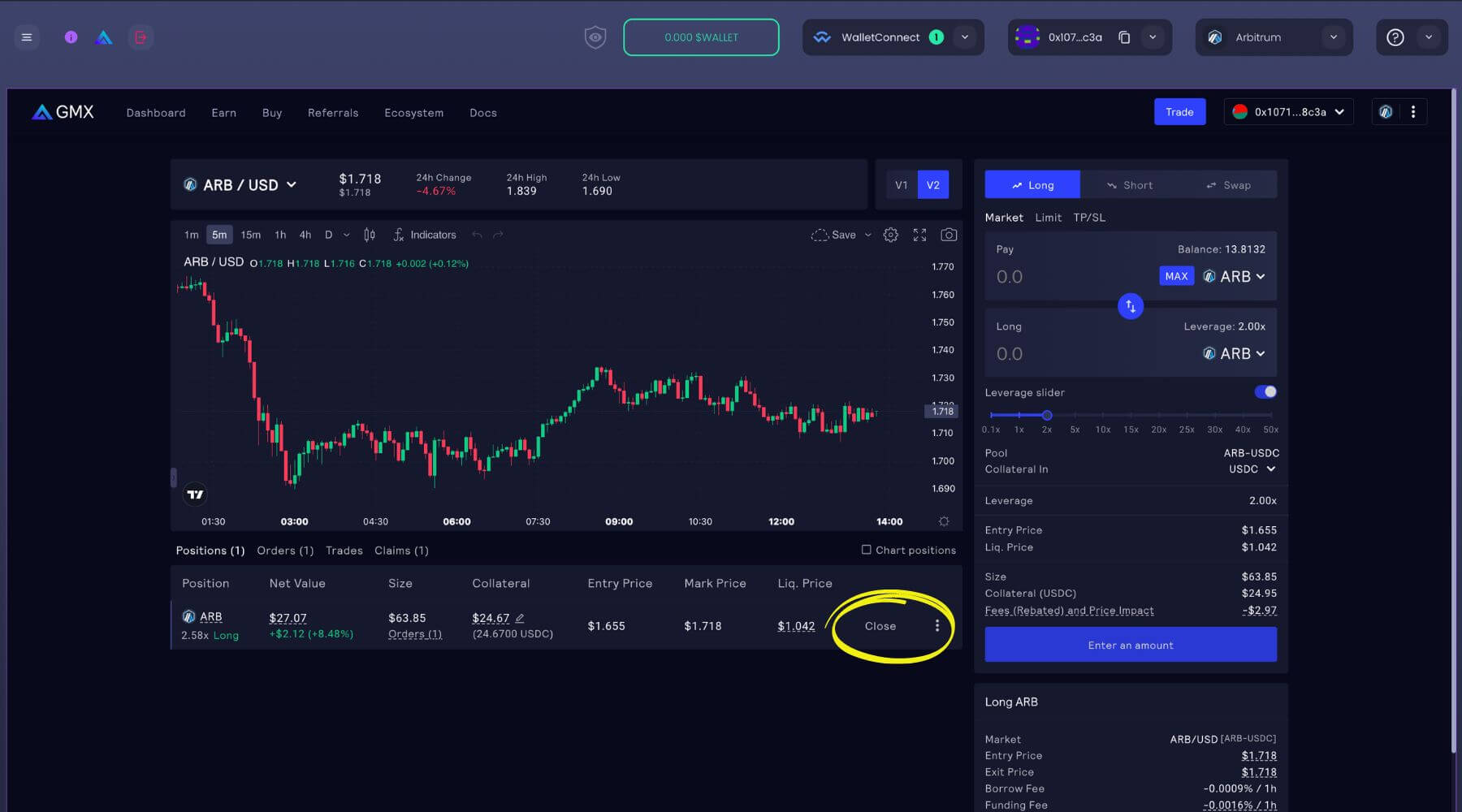

Step 1. Navigate to the positions list

- Go to GMX’s dashboard. You will see the position list beneath the chart on the left-hand side. You should be able to see any open positions.

- To close a position, select ‘Close’ at the end of the row.

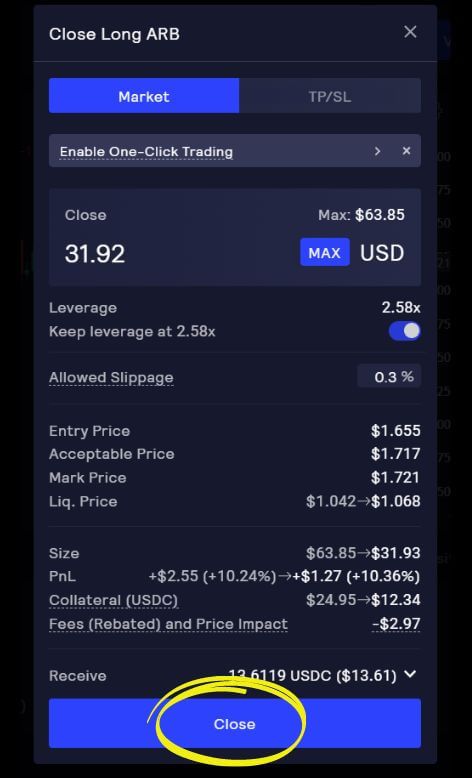

Step 2. Close the position

- In the modal window, select the order amount, e.g., half of the amount of the position.

- Review the information, and select ‘Close.’

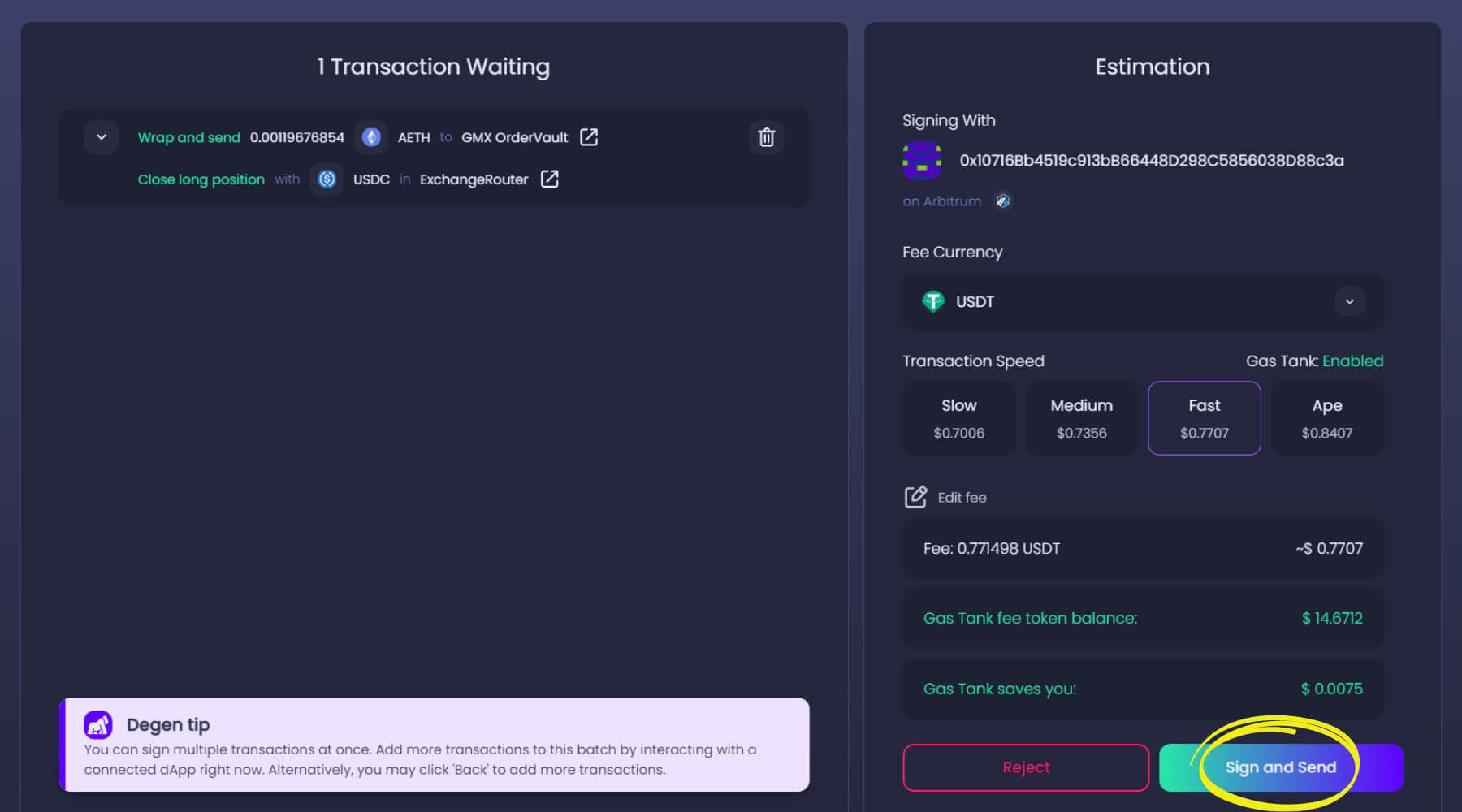

Step 3. Sign and send the transaction

- Review the transaction details.

- Pick the fee currency and transaction speed, then select ‘Sign and Send.’

Here’s a short video tutorial showing how to use GMX inside Ambire Wallet:

Summary

This article explores the dynamics of perpetual swaps and their role in DeFi, highlighting their functionality and benefits. We've also introduced GMX, a key player in decentralized perpetual contract trading. The DeFi Bull Camp campaign offers a practical opportunity to engage with this innovative trading tool, inviting beginners and experienced traders to participate in a trading competition. We encourage you to deepen your understanding of perpetual swaps and DeFi in general and join the vibrant communities of GMX and Ambire Wallet.

Interested in Ambire? Follow us:

Discord | X (Twitter) | Reddit | GitHub | Telegram | Facebook