Introduction to Liquid Staking. How to Earn Yield with Lido Finance

This guide explores leveraging Lido Finance for liquid staking, ensuring your Ethereum works for you in the DeFi ecosystem.

The cryptocurrency space offers various ways for investors to maximize their assets, with staking emerging as a popular strategy for earning rewards on holdings. Among the innovative solutions in this space, Lido Finance stands out for introducing a concept known as liquid staking. This protocol allows users to earn staking rewards without locking up their assets, thereby maintaining liquidity and enabling participation in the broader DeFi ecosystem.

In this article, we delve into the mechanics of liquid staking, its advantages, and how platforms like Ambire Wallet are making it more accessible than ever. Readers will gain insights into leveraging Lido Finance for liquid staking, understand the benefits of this approach compared to traditional staking methods, and learn how to get started with staking their Ethereum to keep it fluid and functional for DeFi activities.

What is liquid staking?

Liquid staking represents a transformative DeFi innovation, enabling Ethereum and other cryptocurrency holders to engage in the network's Proof of Stake (PoS) system without sacrificing asset liquidity. This approach addresses the traditional staking model's limitations, like having 32 ETH as a validator, allowing users to support network security and consensus mechanisms. At the same time, their assets remain free for other DeFi activities.

How does liquid staking work?

Through platforms like Lido, liquid staking transforms cryptocurrencies like Ethereum or Polygon into tokenized assets, such as stETH or stMATIC. These tokens are pegged 1:1 to the original staked asset, plus any rewards, ensuring liquidity within the DeFi ecosystem. This allows users to retain flexibility, using their tokenized assets for various DeFi activities without having to unstake, thus enjoying the benefits of staking rewards while participating in the broader DeFi market.

Differences between liquid staking and traditional staking

Liquid staking allows users to stake their assets and receive tokenized equivalents, as mentioned above, maintaining liquidity for other DeFi activities, unlike traditional staking, where assets are locked and illiquid. Liquid staking platforms like Lido offer more accessibility and utility, enabling staked assets to earn rewards while still being available across the DeFi ecosystem. This approach simplifies user participation and democratizes access to staking rewards, contrasting with traditional staking methods' more rigid and inaccessible nature.

How to stake on Lido Finance with an Ambire Wallet

Lido allows for staking on Ethereum and Polygon, but this guide will focus on Ethereum staking. The process for Polygon is similar. For those looking to participate, having disposable ETH at hand is essential. Additionally, engaging in this staking process requires an Ambire Wallet account. If you don't already have one, creating an account is necessary to participate in the campaign.

Step 1. Accessing Lido in Ambire Wallet

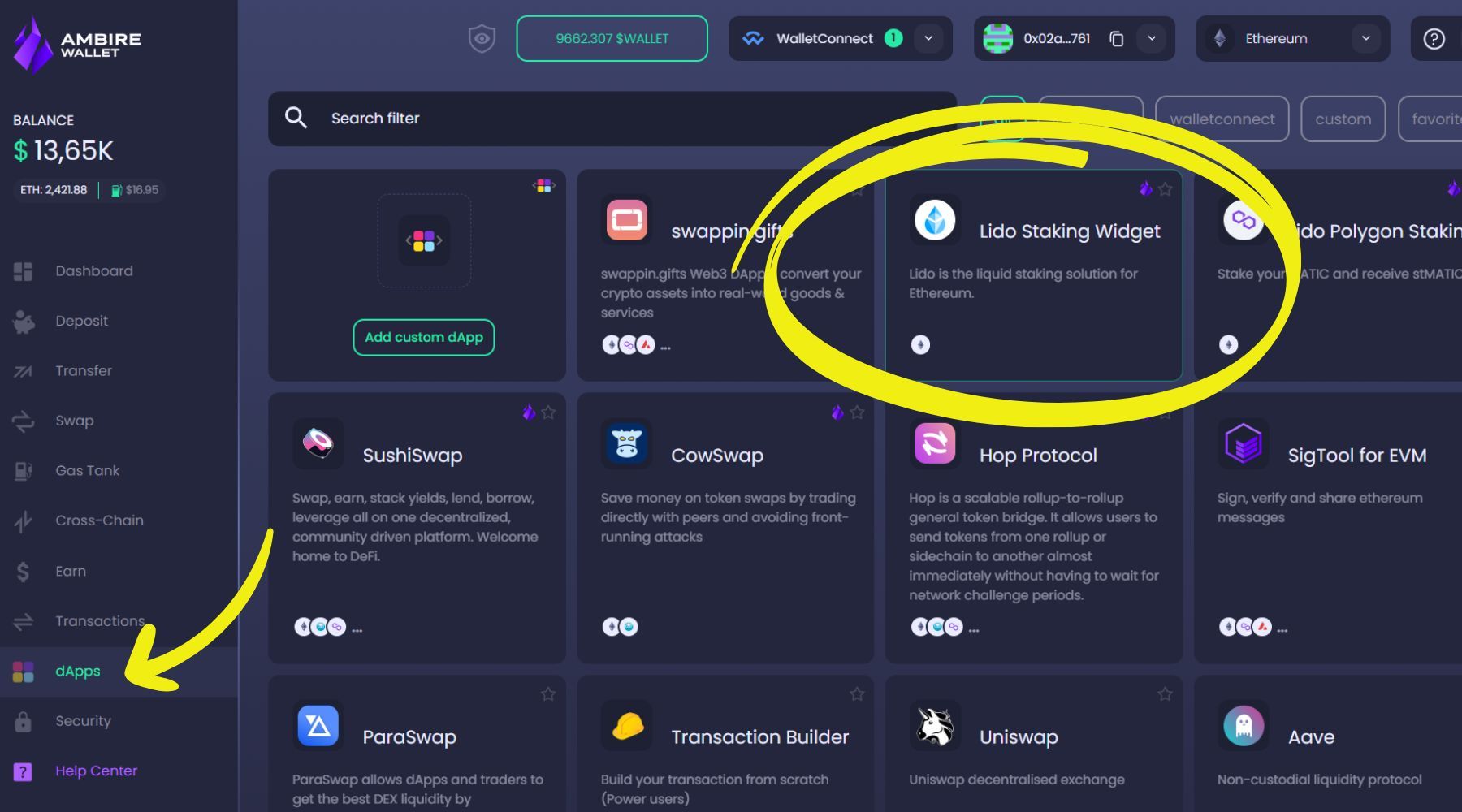

- Go to your Ambire Wallet account.

- From the Ambire Wallet menu, navigate to the 'dApps' section.

- Locate and select the Lido Staking Widget to stake Ether. Once selected, your Ambire Wallet address will automatically connect with Lido.

Step 2. Stake Ether

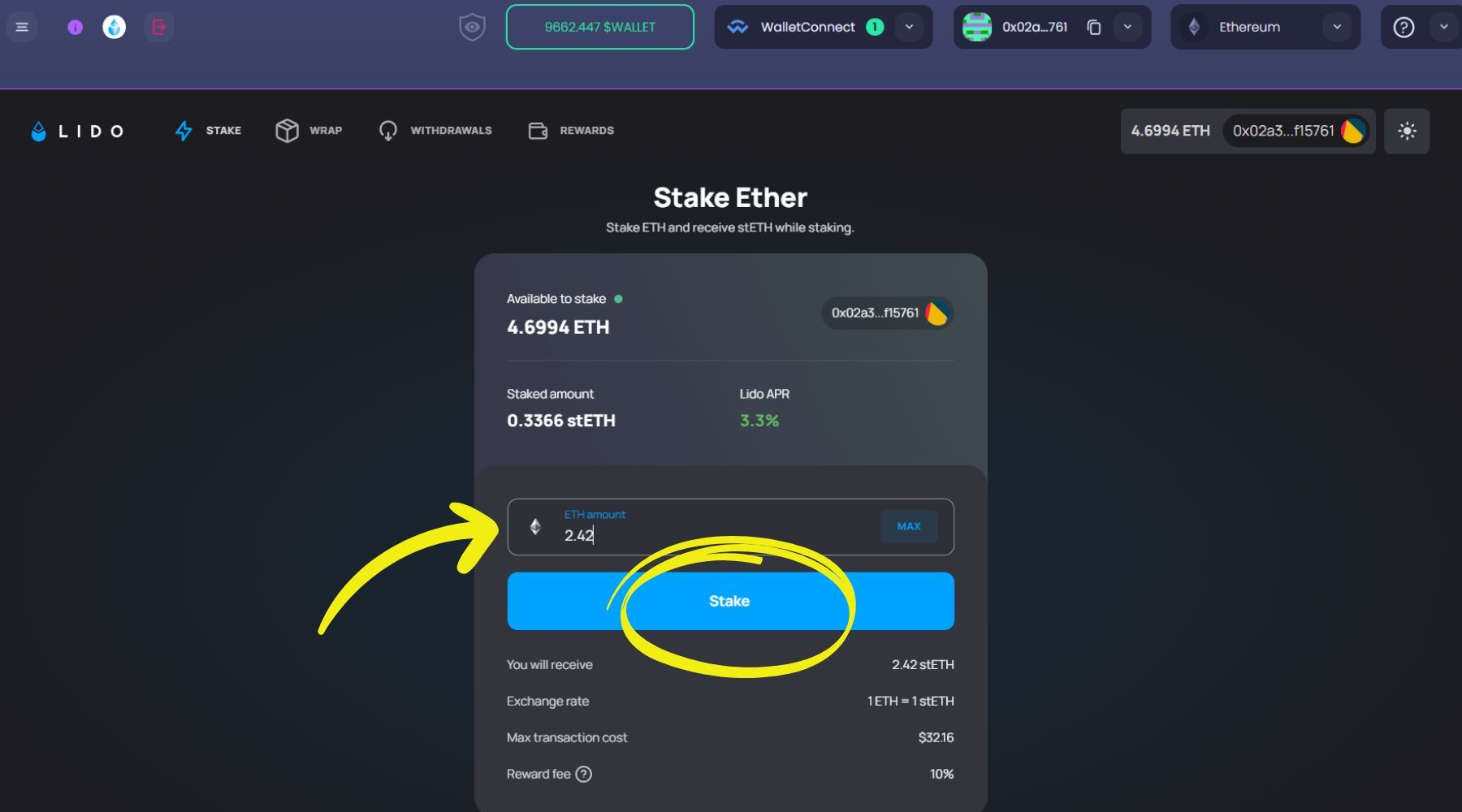

- Choose the amount of Ether you wish to stake.

- Initiate the staking process by selecting 'Stake.'

Step 3. Complete the staking transaction

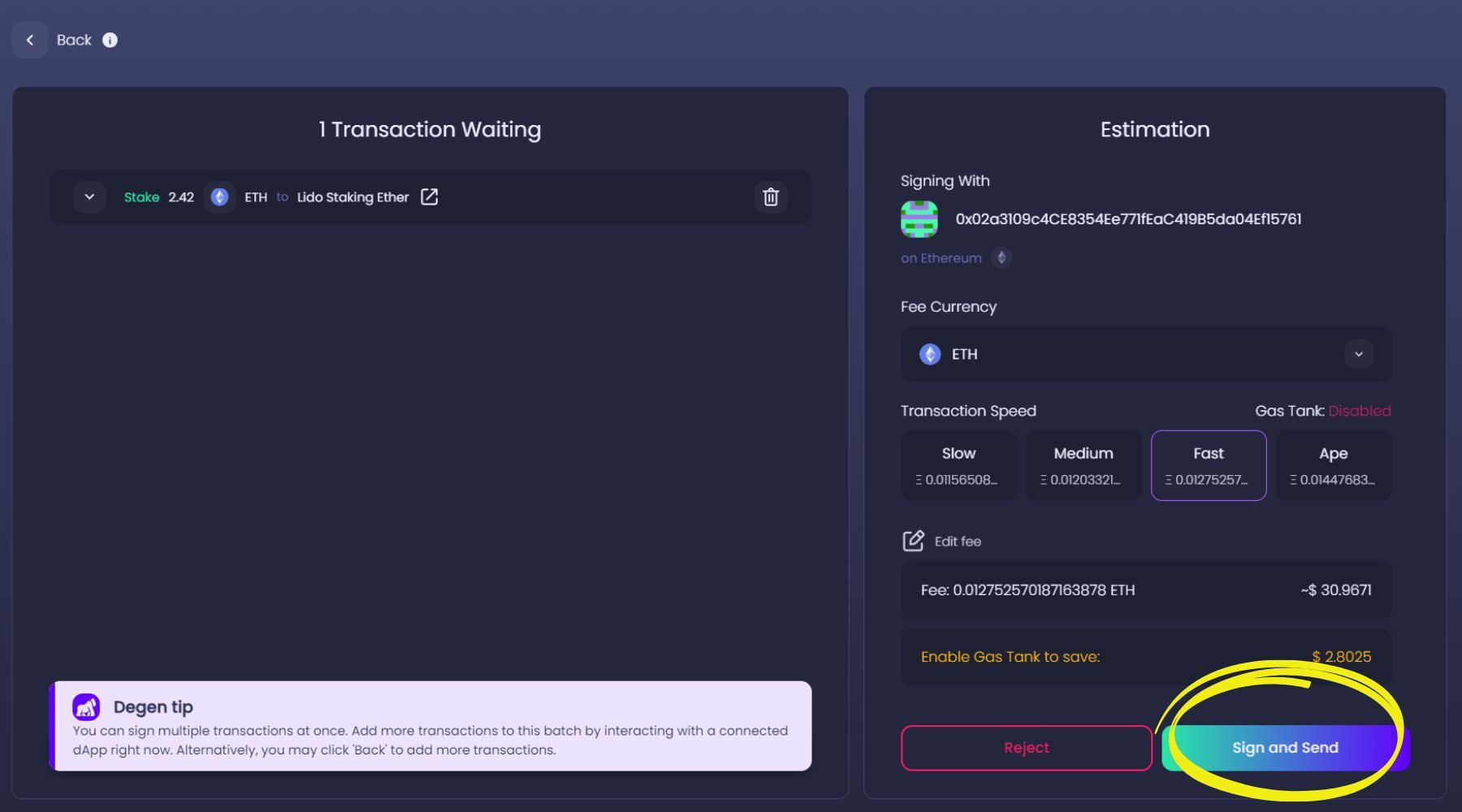

- You will see the Ambire transaction’s page. Review the transaction details, including the amount of Ethereum to be staked.

- Select your preferred fee currency and transaction speed.

- Confirm and sign the transaction by selecting ‘Sign and Send.’

How to unstake Ether from Lido

Step 1. Submit a withdrawal request

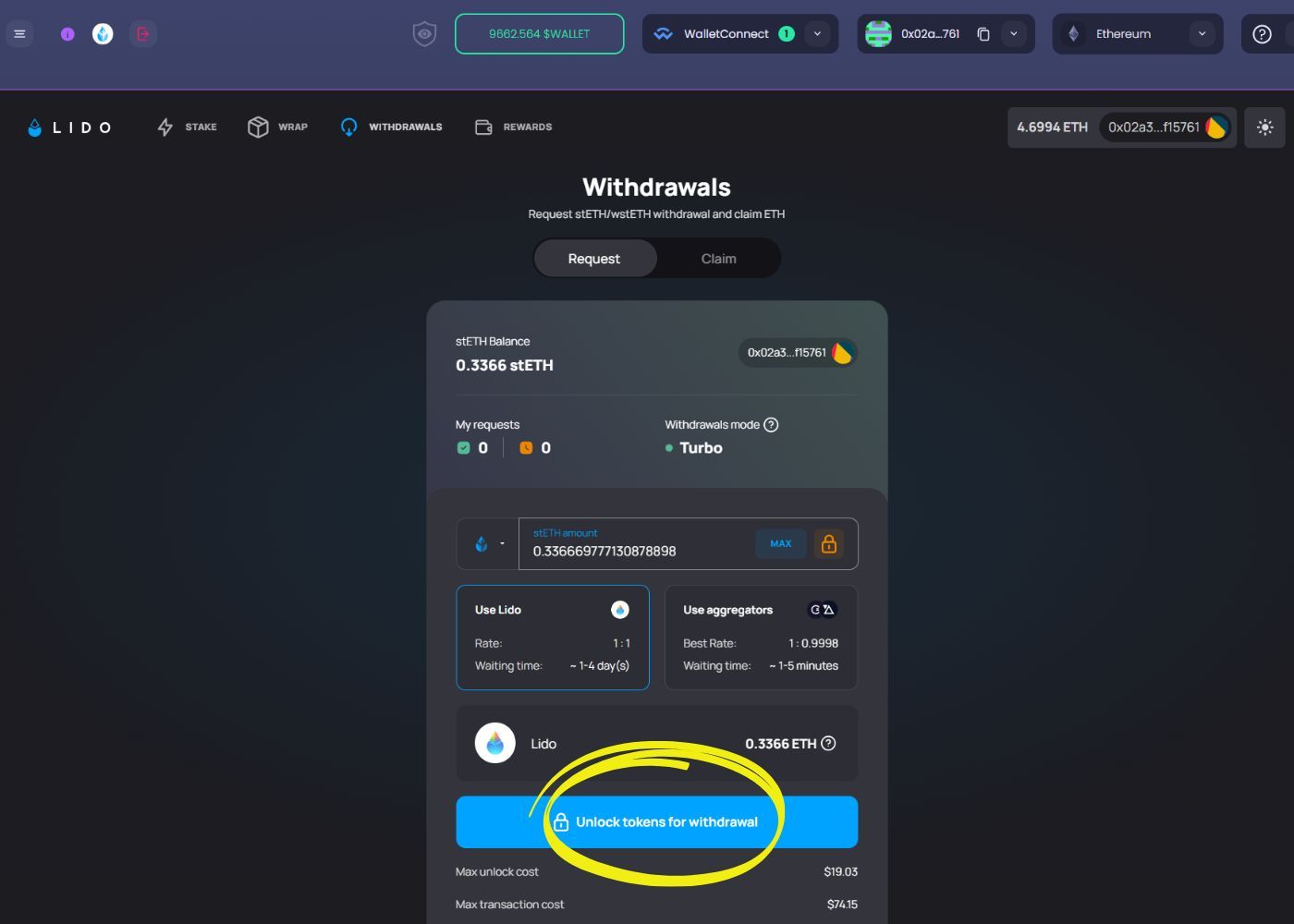

- From Lido’s menu, select 'Withdrawals.'

- Choose the amount you wish to unstake (withdraw).

- Select ‘Unlock tokens for withdrawal.’

Step 2. Sign the withdrawal

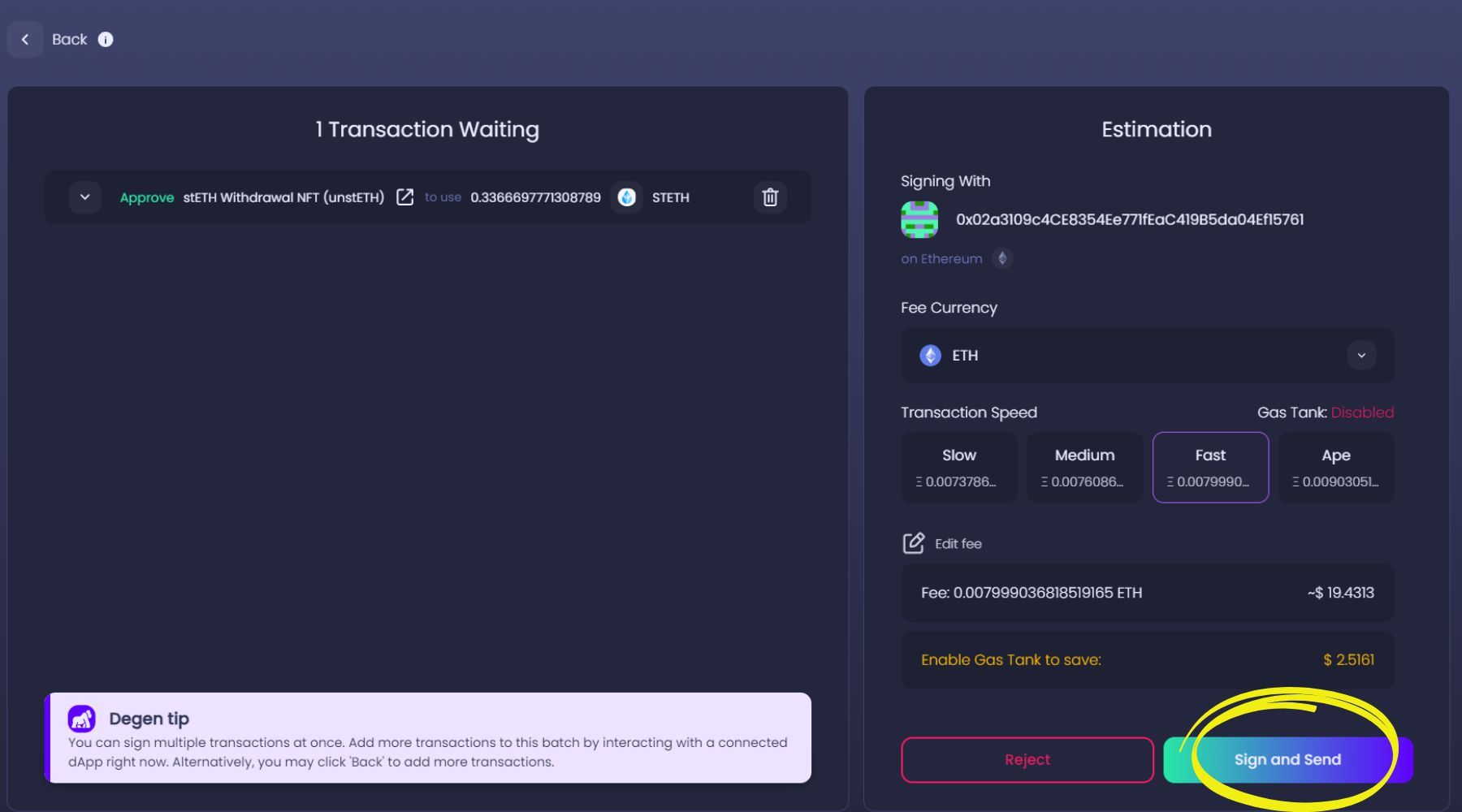

- You will see the Ambire transaction’s page. Review the transaction details, approving Lido to use your stETH tokens.

- Select your preferred fee currency and transaction speed.

- Confirm and sign the transaction by selecting ‘Sign and Send.’

Step 3. Wait for fulfillment and claim your ETH

The withdrawal fulfillment may take between 1 and 5 days, so be patient. Here are the steps to claim your ETH back.

- Go to the dApps section and select Lido Staking Widget. Your account will be connected automatically.

- Select one or more withdrawal requests from the ‘Ready to claim’ list and select ‘Claim.’

- You will see the Ambire transaction’s page. Review the transaction details, select your preferred fee currency and speed, and then ‘Sign and Send.’

Here’s a video tutorial going through the process on the web and mobile versions:

Video tutorial on how to stake Ether on Lido with Ambire Wallet

Summary

This article explores liquid staking with Lido, highlighting its benefits over traditional staking, especially regarding accessibility, utility, and participation. By addressing the 32 ETH barrier in traditional staking, liquid staking with Lido allows for more inclusive participation with tokenized assets that maintain liquidity and can be utilized across DeFi. The guide also includes a step-by-step process for staking Ethereum using Ambire Wallet, emphasizing the simplicity and rewards of engaging in liquid staking.

Interested in Ambire? Follow us:

Discord | X (Twitter) | Reddit | GitHub | Telegram | Facebook